Embarking on the quest toward financial stability demands a thoughtful plan. It's not just about earning money, but wisely managing your resources. This detailed guide provides you with actionable steps to master the challenges of personal finance and foster a secure financial future.

- , Begin by developing a realistic budget that monitors your income and expenses.

- Next pinpoint areas where you can trim spending.

- Emphasize building an emergency fund to address unexpected financial adversities.

- Investigate various investment strategies that align with your risk tolerance and investment goals.

- Turn to a financial advisor for tailored advice and guidance.

Taking Control of Your Finances: Achieving Your Personal Finance Goals

Securing your financial future is a journey that involves careful planning and consistent effort. It's about creating a solid foundation for your dreams by implementing smart money management strategies. Whether you're saving for retirement, acquiring a home, or simply striving for financial security, mastering your money is key to unlocking your full potential.

Start by creating a comprehensive budget that records your income and expenses. This will offer valuable insights into your spending habits and highlight areas where you can minimize.

Next, explore various investment possibilities that align with your risk tolerance and aspirations. A diversified portfolio can help mitigate risk and boost your returns over time.

Don't forget the importance of reserve funds. Aim to build 3-6 months worth of living expenses in a readily accessible savings. This will provide a safety net in case of unexpected events, such as job loss or medical emergencies.

Finally, consult with a qualified financial planner who can provide personalized guidance tailored to your unique circumstances. Remember, mastering your money is an ongoing endeavor that requires consistent attention and adjustments along the way.

Savvy Saving Techniques for a Secure Future

Secure your financial future by implementing smart saving strategies. Start by creating a budget and tracking your expenses. Identify areas where you can trim spending and allocate those funds to your savings goals. Consider setting up automatic transfers from your checking account to your savings account each month.

This consistent approach will help you build a solid financial foundation over time. Explore different savings options, get more info such as high-yield savings accounts, certificates of deposit (CDs), or investment plans. Diversify your savings to manage risk and maximize potential returns.

Remember to review your savings plan regularly and make adjustments as needed based on your financial circumstances. With a well-thought-out savings strategy, you can pave the way for a more secure future.

Conquer Like a Boss: How to Make Your Money Work for You

Stop wasting your hard-earned cash like it's going out of style. It's time to take control of your finances and make your money work alongside you. This means creating a budget that's not just about cutting back, but about investing your wealth.

Here are a few tips to help you manage like a boss:

* Monitor your expenses. You can't improve what you don't quantify.

* Establish realistic financial objectives. What are you accumulating for?

* Program your savings. Make it consistent so you don't even have to consider about it.

* Allocate wisely. Don't put all your eggs in one basket.

* Evaluate your budget regularly and adjust as needed. Life is fluid, so your budget should be too.

Remember, budgeting isn't about restriction. It's about control.

Amassing Your Future Wealth Through Savings

Embarking on the journey to financial freedom involves a strong foundation built upon disciplined preservation. While it may seem like a daunting task, cultivating consistent savings habits can transform your monetary outlook. Start by establishing a sensible budget that assigns funds for essential expenses, immediate goals, and future aspirations.

- Identify areas where you can trim expenditures.

- Automate regular transfers to your savings account.

- Investigate high-yield investment options to maximize your returns.

Keep in mind that building wealth through savings is a quest, not a sprint. Stay dedicated to your monetary goals and celebrate your progress along the way.

Overcome Debt and Reach Financial Freedom

Feeling weighed down by debt? You're not alone. Many individuals struggle with financial obligations, blocking them from living a life of abundance. The good news is that you can triumph over this cycle and achieve true financial freedom. It starts with taking ownership of your finances and developing a solid plan to eliminate your debt. Building a budget, targeting areas where you can cut back, and exploring financial tools are all crucial steps in this journey.

- Seek professional guidance from a financial advisor to develop a personalized strategy that aligns with your goals.

- Persevere driven by visualizing the rewards of becoming debt-free. Picture yourself living a life of independence.

Keep in mind that defeating debt is a marathon, not a sprint. It takes dedication, but the rewards are well worth it. Embrace a mindset of prosperity and believe in your ability to achieve financial freedom.

Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Anthony Michael Hall Then & Now!

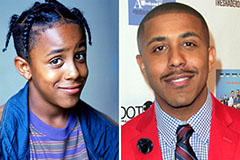

Anthony Michael Hall Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!